aclu not tax deductible

The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation. Your membership dues support our legislative advocacy and lobbying work.

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Business Tax Deductions Tax Deductions

The ACLU is made up of two corporations.

. I give to the American Civil Liberties Union Inc. ACLU Membership not tax-deductible Join the ACLU of Texas a 501c4 non-profit or renew your membership. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

Making a gift to the ACLU via a wire transfer allows you to have an immediate. ACLU monies support our authoritative lobbyingimportant work that cannot be bolstered by tax-deductible reserves. Such a bequest is not deductible for purposes of federal estate tax but can be used most flexibly by the ACLU including for legislative lobbying.

A donor may make a tax-deductible gift only to the ACLU Foundation. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. This is because donations in support of legislative advocacy supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them are not tax deductible.

Since that work is political membership dues and gifts designated to the Union are not tax-deductible. It is the membership organization and you have to be a member to get your trusty ACLU card. ACLU monies fund our legislative lobbyingimportant work that.

You can read all about it on this page of the ACLUs website. Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are. These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501 c3 - and therefore contributions made to the ACLU are not deductible as charitable contributions.

Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. Over the past year the ACLU has fought against a resurgent wave of extremism in all 50 states. The Union and Foundation.

The Union does our political lobbying and advocacy work. ACLU membership dues fund the work of the Union. For more information see the ACLU website on this.

They also enable us to advocate and lobby in legislatures at the. Membership contributions always fund the Union. The ACLU of Illinois is a 501c 4 organization dedicated to protecting and extending liberty primarily through legislative advocacy.

The ACLU Foundation does our public education outreach and litigation. While not tax deductible they advance our extensive litigation communications and public education programs. The ACLU could be a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

The tax ID of the American Civil Liberties Union is 13-3871360. When you make a contribution you become a card-carrying member of the ACLU and the ACLU of Texas and the gift is not tax-deductible. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

The American Civil Liberties Union Foundation ACLU Foundation is a 501 c 3 a tax-exempt. A donor may make a tax-deductible gift only to the ACLU Foundation. Gifts to the ACLU Foundation are fully tax-deductible to the donor.

When you make a contribution you become a card-carrying member of the ACLU and the gift is not tax-deductible. ACLU Membership not tax-deductible Join the ACLU of Northern California a 501 c4 non-profit or renew your membership. As other answers have noted the ACLU proper is a tax-exempt organization per section 501 c4 of the Internal Revenue Code.

Join the ACLU. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. The ACLU is a 501 nonprofit corporation but gifts to it are not tax-deductible.

Your membership dues support our legislative advocacy and lobbying work. See above if youd like your gift to be tax-deductible JOIN THE ACLU. The American Civil Liberties Union ACLU is a 501 c 4 a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible.

Make a Tax-Deductible Gift to the ACLU Foundation. A District of Columbia nonprofit corporation that is recognized as exempt from tax under Section 501 c 4 of the Internal. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible.

Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. The American Civil Liberties Union of Maryland is a 501c4 which means that contributions are not tax-deductible and can be used for political lobbying.

The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough. Gifts to the ACLUs Guardian of Liberty monthly giving program are not tax deductible. The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible.

Gifts to the ACLU of Illinois are not tax-deductible. ACLU monies fund our legislative lobbying--important work that cannot be supported by tax-deductible funds. It is the enrollment organization and you have got to be a part to urge your trusty ACLU card.

It is the membership organization and you have to be a member to get your trusty ACLU card. Gifts to the ACLU allow us the greatest flexibility in our work. Membership gifts to the ACLU of Massachusetts are generally not tax-deductible.

The ACLU Foundation of Maryland is a 501c3 charity which means that contributions are tax-deductible and cannot be used for political. The ACLU of Illinois has been the principal protector of constitutional rights in the state since its founding in 1929. Now more than ever we need you by our side.

The ACLU of Massachusetts is an IRS 501 c4 organization that funds all of the ACLUs work including litigation education organizing lobbying and legislative advocacy.

Aclu Donations How To Make A Tax Deductible Gift Money

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Rental Property Management Real Estate Rentals

Why Are Donations To The Aclu Not Tax Deductible Quora

Functionalbest Of Self Employed Tax Deductions Worksheet Check More At Https Www Ku Small Business Tax Deductions Business Tax Deductions Small Business Tax

Pin By Wan M On Politics History Current Events Global Dod Family Separation Make A Donation Supportive

Chris Sacca On Twitter I M Inspired By All Who Are Barely Scraping By Yet Still Giving Monthly To The Aclu Show Me Your Receipts And I Ll Match Em To 75k

Donate To The Aspca And Help Animals Aspca Animal Donations Animals

Why Tax Deductions Are So Important For Your Business Bookkeeping Business Small Business Bookkeeping Business Tax

Victoria 3 Bet Repayment Log R Paradoxplaza

Why Are Donations To The Aclu Not Tax Deductible Quora

Fund The Fight Support The Aclu Of Massachusetts American Civil Liberties Union

Why Are Donations To The Aclu Not Tax Deductible Quora

Gifts Through Your Will American Civil Liberties Union

Are Credit Card Fees Tax Deductible Discover The Truth

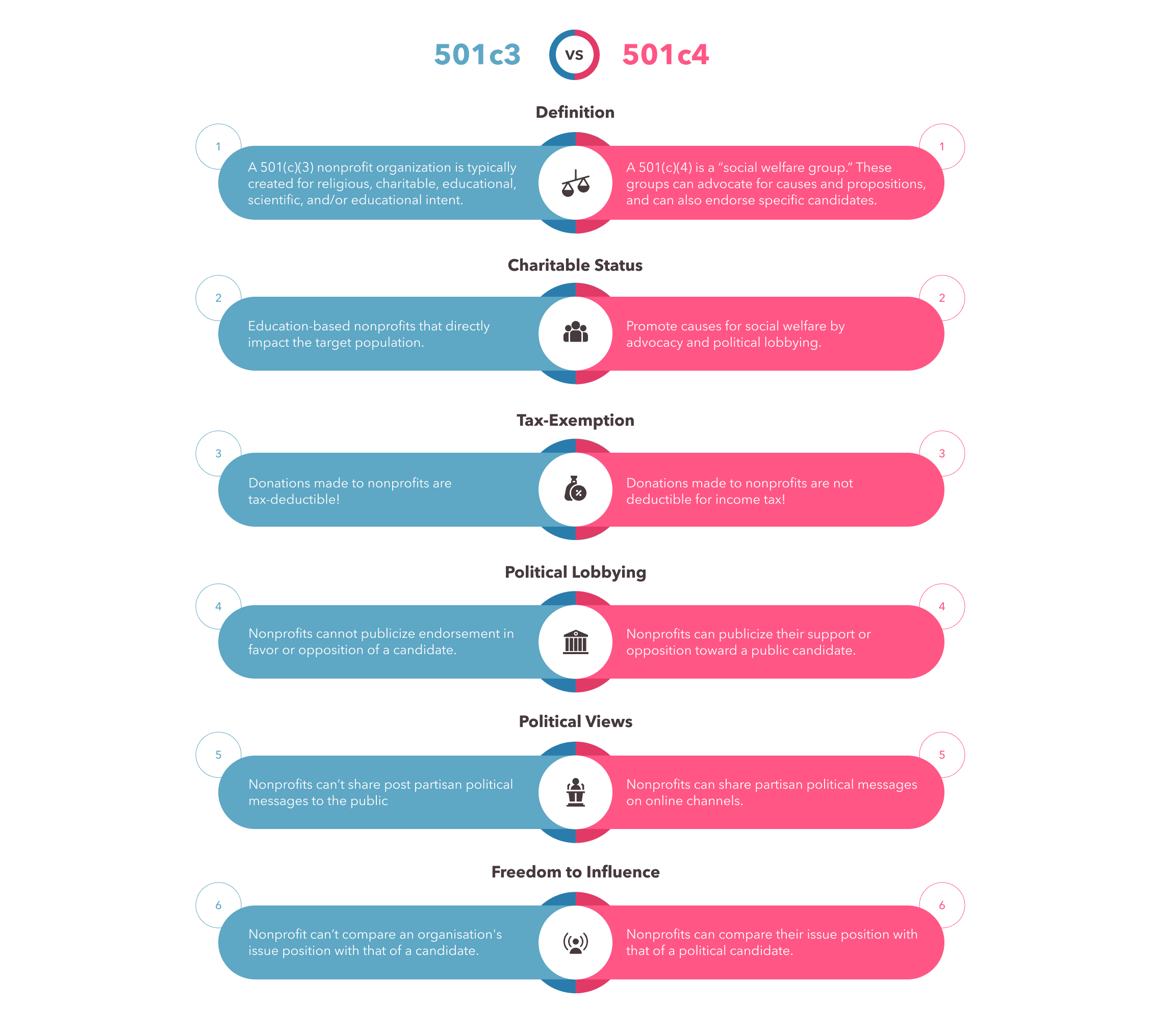

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Real Charity Doesn T Care If It Is Tax Deductible Or Not Dan Bennett Quotes To Live By Words Quotes

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets

Get Our Printable Tax Deductible Donation Receipt Template Receipt Template Receipt Tax Deductions